MENU

- About Us

- Products & Market Data

- Listing & Issuer Services

- Education & Investor Services

- Regulations & Governance

- CDS

- Contact

About Us

SEM at a glance

The Stock Exchange of Mauritius (SEM)'s 35+ years of history since its humble beginning is one where the Exchange has constantly strived to break new grounds to overcome the structural constraints of an island economy where the universe of products, investors and market participants is relatively restricted. Since 1989, SEM has come a long way and its transformational journey and successful positioning as one of the leading Exchanges in Africa, is a quite enticing story.

SEM today has a state-of-the-art operating system, trading is effected daily for five-and-a-half hours, the settlement cycle is T+3, the total market capitalisation has crossed the USD 8.5 billion mark, and the internationalisation process is in full swing. We have set up a multi-currency listing, trading and capital-raising platform and modernised our listing framework to list a wide variety of multi-asset class products. Likewise, we have contributed to the democratisation of the economy by allowing 100,000+ Mauritians acquire shares in the flagship local companies, helped companies raise USD 6.5+ billion over time to fund their growth, and create value for the vast majority of issuers that have chosen to list on our platform.

SEM's transformative momentum took a new turn in 2010 when the Exchange undertook a fundamental shift of its strategic orientation, embarking with the internationalisation of its operational and regulatory framework. The outcome of this strategic shift has been quite compelling. 180+ securities are listed on SEM, cutting across different asset-classes and issued by a diverse group of local, African and international issuers. SEM's market capitalisation to GDP ratio is 60%+. SEM today boasts a streamlined listing regime catering for the specialist nature and requirements of a variety of asset classes. These cover equity products (ordinary/preference shares), debt products (fixed income/floating rate debt/specialist debt products and Eurobonds), ETFs, ETNs, DRs and Structured Products. The above products are issued and listed by domestic Issuers, International Issuers, Investment entities, Specialist companies (including GBCs) and Public sector issuers.

The assistance of the French authorities and expertise from the Bourse de Paris were initially sought to set up the appropriate market infrastructure and draft the legislation governing stock market operations. SEM’s first chairman, George Ramet, used the Bourse of Lyon as an inspiration in modelling the Stock Exchange of Mauritius.

SEM started its operations in July 1989 with the Official Market with five listed companies (MCB, MDIT, UBP, Mauritius Stationery Manufacturers Ltd and Mon Tresor Mon Desert Ltd) and a market capitalisation of USD 70 million.

Ten stockbroking companies were registered to operate on the Exchange at inception in July 1989. At the start, trading took place once a week under the Box Method.

In a quest to increase transparency and make the market more dynamic, the Box Method was replaced in September 1991 by the order-driven single price auction Open Outcry System.

Foreign exchange controls were lifted in 1994 and the market was opened up to foreign investors. In its first year, net inflows by foreigners reached Rs38.9 million, representing 2.5% of the year’s turnover.

As a salient innovation as part of SEM's core technology infrastructure, with the view to opening up to the world, SEM launched it's first website version in 1997, showcasing 15-min delayed market data of all listed instruments, trading prices and other specs for market participants globally. The website also displayed amongst others, content on SEM's CDS, trading and listing rules as well as timely corporate actions and financials by law from issuers at the time of filing at the Exchange.

The CDS was also established as a subsidiary of the SEM in 1997. The CDS set-up brought about prompt and efficient clearing and settlement of trades on T+3 while at the same time reducing risks in the process. SEM's CDS complies with IOSCO and BIS' PFMIs, as relayed via SEM's website.

Post demutualization of SEM's capital structure in 2000, SEM’s transformative technology momentum took a new turn in 2001 when SEM became the first Exchange in Africa in June 2001, to move away from an open-outcry system since 1991 to a fully-automated market infrastructure, to match buy/sell orders placed by licensed investment dealers. With each investment dealer having in its office a front-end terminal connected with a server located at the SEM, the central system software consisted of an electronic order book enabling brokers to post their buy and sell orders on behalf of their clients and have their orders matched automatically. Upon order matching, the investment dealer would be immediately receiving a confirmation of the execution of the trade. SEM's ATS solution between June-2002 to 13-May-2022, was running on MIT Technology.

In terms of Regulatory Alignment with Global Standards, SEM operates within a strong legal and regulatory framework aligned with the standards of the World Federation of Exchanges (WFE), IOSCO principles and has obtained “Recognised Stock Exchange” status from international authorities, including the UK’s HMRC. SEM is a member of the WFE since 2005 and represented the EMEA region on the Board of the WFE between 2014 and 2021. SEM is a member of the SADC Committee of Stock Exchanges (COSSE) and of the African Securities Exchanges Association (ASEA).

SEM is also a designated Exchange since 2010, by the Cayman Islands Monetary Authority (CIMA), as an Approved Stock Exchange. SEM became designated since 31 January 2011, by the United Kingdom’s Her Majesty’s Revenue and Customs (HMRC), as a “recognised Stock Exchange”, as a result of which, securities traded and listed on the Official Market of the SEM meet the HMRC interpretation of “listed” as set out in section 1005 (3) (a) and (3) (b) Income Tax Act 2007. SEM is also regarded as a ‘recognised Stock Exchange’ for Inheritance Tax purposes.

In 2010, SEM embarked on a deliberate transformation journey to reposition itself beyond its original domestic and equity-centric footprint. This marked the beginning of its transition into a multi-asset, multi-currency, and internationalised exchange, enabling it to attract the listing of 255 new securities, of which, 124 are from international issuers.

Key milestones of SEM's strategic shift include:

- Expansion into New Asset Classes: SEM introduced new listing and trading segments for a wide variety of financial products , Specialist Debt-instruments, Exchange-Traded Funds (ETFs), Exchange-Traded Notes (ETNs), Structured Products, Depositary Receipts, significantly expanding the product offering on its two markets- The Official Market, which caters for well-established companies with solid track-records, and the DEM which caters for SME’s and Start-Up’s with promising outlooks.

- Multi-Currency Platform: SEM’s automated trading, clearing and settlement infrastructure was enhanced to support trading, clearing and settlement in multiple currencies—MUR, USD, EUR, GBP, and ZAR—making it easier for foreign issuers and investors to participate.

- International Listings Growth: From only a handful of foreign listings pre-2010, SEM today has over 55 international issuers listed on its platform. These include issuers from different countries, with listings in equity, debt, ETF’s and structured products. SEM also hosts the listing of a 9 dual listed issuers who are also listed on exchanges such as the JSE, Nambian Stock Exchange and the Botswana Stock Exchange.

SEM has developed in 2017 a fast-track-listing route for issuers having a primary listing on select Exchanges, which can submit the same listing application documents approved by the Exchange of primary listing to the SEM. The fast-track listing process effectively eliminates time, cost and management constraints for the issuer with regard to the preparation of application documents.

Further flexibility introduced in the Listing Rules for international issuers having a secondary listing on the SEM also include a reduced regulatory gap as the post-listing obligations of the Exchange where the international issuer has its primary listing take precedence over the post-listing obligations of the SEM. On top of optimal turnaround time in guiding issuers them throughout the admission process, compared to peer-Exchanges, SEM also ensures a highly cost-effective and competitive listing fee structure, providing affordable entry and continued listing.

Investors today look for fully-integrated services with capabilities of doing everything from smart devices and want everything intuitive, instant and on-demand. Technology plays squarely into that space – provide fully-integrated instant,24/7, and fast on-demand investor services. On the technology infrastructure side, SEM rolled out a fully-responsive website in 2019, running on latest technology and cloud infrastructure, to connect the Exchange to all local stakeholders and the world.

In terms of this overhaul of SEM's core technology infrastructure, SEM's web infra features an entirely new dynamic look and feel, displaying a full suite of dynamic market data, and web-pages have been streamlined, grouping information on SEM's multi-asset classes more efficiently and in an interactive fashion. This web infra embraces the wave of emerging technologies like AI, interactive charting & Tab/Graphic Displays, that improve investor experience. SEM website’s Data Centre also provides secure cloud services for market participants.

In 2020, the SEM added a new strategic dimension to its innovative thrust by amending SEM Trading Rules to create a conducive environment for the establishment of links with International Central Securities Depositories (ICSD's) like Euroclear and Clearstream.

This new enabling environment specifically applies to Debt Securities, Specialist Debt Securities, Eurobonds, ETF's, ETN's) and Structured Products listed on SEM and issued by foreign issuers to foreign investors or investment entities holding a Global Business Licence. In practice, this initiative allows foreign investors who own the above-named securities listed on the SEM and which have an ‘XS’ ISIN issued by an ICSD, to transfer these securities directly via the ICSD to other investors.

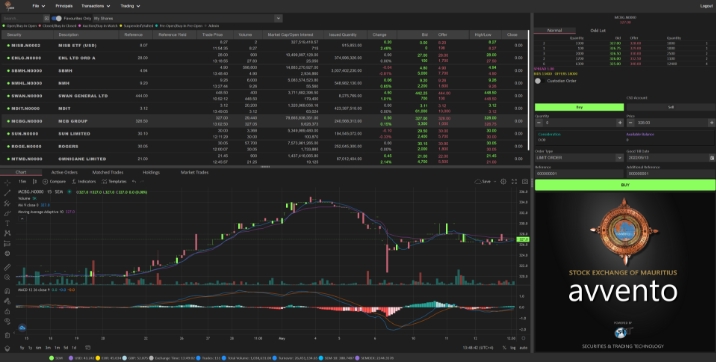

In May 2022, SEM marked the successful go-live of its new multi-asset Automated Trading System (ATS), comprising a rich and robust desktop trading front-end for brokers and a modern web and mobile mySEM App for investors at large.

This new 2-pronged upgrade as part of SEM's core technology infra (new website infra in 2019 and new trading infra in 2022) enable SEM to continue on the path of innovation in pursuing its differentiation strategy to position itself as an attractive multi-currency capital-raising and listing platform, and move up the value-chain of products and services for its local and international stakeholders. The new solution also allows further growth and development of the market through the latest API’s and integration points via FIX API for Data Distributors, Brokerage Houses and the like for connectivity, as well as the ability to trade new potential asset-classes such as derivatives. The new ATS also incorporates a state-of-the-art Market Surveillance System which enhances RT surveillance of market activities. The alert engine runs in real time to raise any alerts for market abuse or irregular trading practices.

SEM launched in May 2022, a new fully responsive mySEM app with a new look and feel, introducing new and enhanced interactive app functionalities The new mySEM app version is a Progressive Web App (PWA), delivered through the web via URL https://mysem.stockexchangeofmauritius.com and can be used on any platform (desktop and mobile), within the palm reach of investors.

The mySEM app aims at empowering investors to follow the market in real time, seize market opportunities and trade in real time, and have online access to their CDS accounts to monitor their account activity and account status. In addition to the new look and feel, mySEM also provides investors seamless access to a wide variety of market data in real time, including company specific order books, highs and lows, best bids and asks, and other relevant company-specific data. It also introduces interactive charting for all listed securities on different time-scales up to 1 year. This new mySEM app relates to a number of ground-breaking initiatives implemented by the SEM in recent years to avail investors of improved digital services and enhanced trading and operational efficiency.

In the context of SEM's reform of Market Data Operations, effective 01-November-2023, SEM crafted a Market Data Policy in line with international practice to license FIX (Level 1 and level 2), Text-File Delayed and EOD for instrument, index and corporate file data [corporate announcements (CA), 1/4 issuer financials]. SEM's website infrastructure also provides secured cloud services for market participants to relay data feeds onto their websites.

In line with SEM's Market Data Policy, any form of distribution for all dissemination frequencies of RT Level 1/2 and/or Delayed/EOD by Data Distributors/Re-distributors and Data Users (incl. Clients) at large to receive SEM data and relay externally to Data Users, requires SEM's approval and licensing with SEM as Licensees. Hence, whether as a SEM Data User, you receive SEM data for Display-Use and/or Non-Display Use, from SEM FIX API or from SEM's licensed Contracted Distributing Users, you are governed by SEM's Market Data Policy.

The operational and compliance technical documents (“Policy”) on page https://www.stockexchangeofmauritius.com/about-us/market-data-policy represent a statement of the MDP and govern the Display, Non-Display as well as Compliance and Reporting of Data (as defined). Licensees as per global practice, ensure their Data Users comply with SEM's MDP, including relevant charges, reporting requirements and usage restrictions.

SEM is connected to BLOOM, LSEG, Factset, ICE, SIX, S&P Dow, FTSE, MSCI and S&P Global to mention but a few to relay RT Market Data to institutional investors across the world.

SEMx: A New Chapter to Support High-Growth African Enterprises

Recognising the funding challenges faced by fast-growing African companies, SEM launched in December 2024 SEMx, a dedicated growth platform aimed at facilitating access to long-term capital for innovative and scalable African businesses. Upon its launch, SEMx has attracted the listing of 3 companies that operate in the food and agroindustry sectors in Africa and which have shown an average annual growth in revenue exceeding 25%. SEM believes in the potential of the SEMx to emerge as a niche platform for small but fast growing African companies and has already received indications that more listings of similar companies will follow in 2025.

Key features of SEMx include:

- Tailored Listing Criteria: Designed to meet the needs of high-growth companies that may not yet meet main board requirements but with a proven track record of exceptional growth and strong future potential.

- Private and Public Offerings: SEMx allows for both private placements and public offerings, enabling flexibility for issuers.

- Required disclosures: SEMx requires companies to periodically disclose their financial statements publicly, as well as material developments in the affairs of the company, with the aim of building investor confidence in African ventures.

- Investor Appetite: By offering transparent disclosures and governance structures, SEMx aims to attract impact investors, DFIs, and growth equity players targeting the African innovation and SME ecosystem.

ESG lies at the core of SEM’s vision, reflecting both global trends and local imperatives:

-

A Decade of Sustainability Leadership: Reflecting in 2025 on 10 Years of the SEM Sustainability Index (SEMSI): At launch, SEMSI comprised 13 constituent companies with a combined market capitalisation of MUR 93 billion. Today, it encompasses 19 sustainability leaders with a market capitalisation of MUR 248 billion—more than double its starting size. Yet SEMSI’s most enduring legacy lies not in the numbers but in its catalytic role in driving corporate change. SEMSI tracks the price performance of companies that have undergone rigorous ESG assessments based on Global Reporting Initiative (GRI) criteria, adapted to the Mauritian context. The vision that inspired SEMSI ten years ago has now become a central tenet of global finance. As climate change and related challenges intensify, the SEM remains committed to advancing this agenda. The next phase for SEMSI will focus on updating and refining its metrics—particularly around climate risk and biodiversity—and on urging listed companies to integrate sustainability deeply into their core business models, moving beyond stand-alone projects.

-

Green Bonds and ESG Products: SEM started working on the development of a green bond ecosystem as far back as 2018, with the launch of its Green Bond Initiative. 3 bonds and currently listed on SEM and the Exchange is currently working on developing the domestic sustainable-bonds market and strengthening ESG reporting standards across the exchange, and SEM remains steadfast in leading the charge toward a more sustainable future for all.

- Partnerships and Recognition: SEM is member of the UN Sustainable Stock Exchanges (SSE) Initiative and a partner in the GFANZ and UNDP SDG Finance initiatives to mobilise climate-aligned capital through public markets.

The SEMYIA Trading Game was launched 33 years ago. In 1993, when the first edition was held, only 25 students from 5 colleges participated in this event. The 2025 edition which kicked off after a pause since COVID-19, mobilised 600 students from 73 colleges, a concrete testimony of the strong momentum gained by this competition over the years. Since 1993, more than 21,000 students have been trained on the workings of the SEM. The SEMYIA Trading Game is a multi-pronged competition, which rests on multiple objectives.

- Philosophy & Objectives

- The Stock Exchange of Mauritius (SEM) has a proud tradition of promoting financial literacy among young Mauritians. At the heart of these efforts lies the SEMYIA Trading Game, launched in 1993 to introduce Grade 12 students to the workings of the stock market. Objectives:

- Develop a savings and investment culture early in life.

- Encourage students to become ambassadors of financial knowledge within their families and communities.

- Provide practical exposure to SEM’s digital investor services (mySEM mobile investment app, SEM website) to follow daily market data and entitlements on Ex-Date, and through interaction with SEM staff and licensed stockbrokers

- Test higher-order analytical and investment skills needed in the investment and financial space—financial and investment analysis, critical thinking, and structured reporting.

- Scale & Impact

- More than 21,000 students have participated over the past 33 years of this competition.

- 600 students from 73 colleges, representing 120 teams of five participants, took part in the 2025 Edition - a testament to the enduring appeal of the competition.

- Investing a hypothetical Rs 200,000 in listed securities, managing their portfolios over a two-month period.

- Grading: 60% on portfolio performance, 40% on the quality and logic of the investment report.

- Broader Significance

- SEMYIA Trading Game nurtures future ambassadors of financial knowledge, investors, entrepreneurs, and policy makers - testing higher-order analytical and investment skills for a generation of financially literate citizens with an investment culture

- It aligns with government’s commitment to deepen our capital markets, strengthen the Mauritius IFC, and build a culture of savings and investment that supports sustainable economic growth.

Future: A Forward-Looking Capital Markets Leader in Africa

Over the past 15 years, SEM has undergone a profound transformation. From its origins as a pre-emerging, equity-centric domestic exchange catering primarily to domestic listings and investors, SEM has boldly redefined its strategic trajectory. Today, it stands as a recognised multi-asset class, niche internationalised platform, deeply rooted in Africa but globally connected. Through carefully designed reforms, pioneering infrastructure investments, strategic product diversification, and a forward-looking regulatory and sustainability agenda, SEM has emerged as a benchmark for other exchanges operating in small, open economies.

The SEM’s journey over the last decade and a half illustrates how a small exchange can strategically transform into a respected niche Africa-focused and international financial platform by innovating, internationalising, and staying true to its core mission of enabling capital formation. As Africa’s capital markets continue to evolve, SEM is uniquely positioned to serve as a launchpad for African enterprises, a trusted platform for international issuers, and a catalyst for sustainable and inclusive growth.

Looking ahead, SEM will deepen its digital transformation, scale SEMx as a pan-African growth engine, pioneer climate-aligned listings, and continue building bridges between international capital and African opportunity. The next chapter is not just about SEM’s growth, but about shaping the future of capital markets in Africa—with Mauritius as its strategic hub.