MENU

- About Us

- Products & Market Data

- Listing & Issuer Services

- Education & Investor Services

- Regulations & Governance

- CDS

- Contact

About Us

SEM at a glance

The Stock Exchange of Mauritius (SEM)'s 35+ years of history since its humble beginning is one where the Exchange has constantly strived to break new grounds to overcome the structural constraints of an island economy where the universe of products, investors and market participants is relatively restricted. Since 1989, SEM has come a long way and its transformational journey and successful positioning as one of the leading Exchanges in Africa, is a quite enticing story.

SEM today has a state-of-the-art operating system, trading is effected daily for five-and-a-half hours, the settlement cycle is T+3, the total market capitalisation has crossed the USD 8.5 billion mark, and the internationalisation process is in full swing. We have set up a multi-currency listing, trading and capital-raising platform and modernised our listing framework to list a wide variety of multi-asset class products. Likewise, we have contributed to the democratisation of the economy by allowing 100,000+ Mauritians acquire shares in the flagship local companies, helped companies raise USD 6.5+ billion over time to fund their growth, and create value for the vast majority of issuers that have chosen to list on our platform.

SEM's transformative momentum took a new turn in 2010 when the Exchange undertook a fundamental shift of its strategic orientation, embarking with the internationalisation of its operational and regulatory framework. The outcome of this strategic shift has been quite compelling. 180+ securities are listed on SEM, cutting across different asset-classes and issued by a diverse group of local, African and international issuers. SEM's market capitalisation to GDP ratio is 60%+. SEM today boasts a streamlined listing regime catering for the specialist nature and requirements of a variety of asset classes. These cover equity products (ordinary/preference shares), debt products (fixed income/floating rate debt/specialist debt products and Eurobonds), ETFs, ETNs, DRs and Structured Products. The above products are issued and listed by domestic Issuers, International Issuers, Investment entities, Specialist companies (including GBCs) and Public sector issuers.

The assistance of the French authorities and expertise from the Bourse de Paris were initially sought to set up the appropriate market infrastructure and draft the legislation governing stock market operations. SEM’s first chairman, George Ramet, used the Bourse of Lyon as an inspiration in modelling the Stock Exchange of Mauritius.

SEM started its operations in July 1989 with the Official Market with five listed companies (Mauritius Commercial Bank, Mauritius Development Investment Trust Ltd, United Basalt Products Ltd, Mauritius Stationery Manufacturers Ltd and Mon Tresor Mon Desert Ltd) and a market capitalisation of USD 70 million.

Ten stockbroking companies were registered to operate on the Exchange at inception in July 1989. At the start, trading took place once a week under the Box Method.

In a quest to increase transparency and make the market more dynamic, the Box Method was replaced in September 1991 by the order-driven single price auction Open Outcry System.

Foreign exchange controls were lifted in 1994 and the market was opened up to foreign investors. In its first year, net inflows by foreigners reached Rs38.9 million, representing 2.5% of the year’s turnover.

As a salient technological breakthrough, with the view to opening up to the world, SEM launched it's first website version in 1997, showcasing 15-min delayed market data of all listed instruments, trading prices and other specs for market participants globally. The website also displayed amongst others, content on SEM's CDS, trading and listing rules as well as timely corporate actions and financials by law from issuers at the time of filing at the Exchange.

This same year, the CDS was established as a subsidiary of the SEM. The CDS set-up brought about prompt and efficient clearing and settlement of trades on T+3 while at the same time reducing risks in the process. SEM's CDS complies with IOSCO and BIS' PFMIs, as relayed via SEM's website.

On the strategic front, SEM's capital structure was demutualized in 2000.

SEM’s transformative momentum took a new turn in 2001 when SEM became the first Exchange in Africa in June 2001, to move away from an open-outcry system since 1991 to a fully-automated market infrastructure, to match buy/sell orders placed by licensed investment dealers. With each investment dealer having in its office a front-end terminal connected with a server located at the SEM, the central system software consisted of an electronic order book enabling brokers to post their buy and sell orders on behalf of their clients and have their orders matched automatically. Upon order matching, the investment dealer would be immediately receiving a confirmation of the execution of the trade. SEM's ATS solution between June-2002 to 13-May-2022, was running on MIT Technology.

In 2005, SEM became a full-fledged member of the World Federation of Exchanges (WFE), a central reference point and standards setter for exchanges and the securities industry in the world.

After further regulatory strides in 2009, SEM was designated in 2010, by the Cayman Islands Monetary Authority (CIMA), an Approved Stock Exchange. Accordingly, SEM became designated since 31 January 2011, by the United Kingdom’s Her Majesty’s Revenue and Customs (HMRC), as a “recognised Stock Exchange”, as a result of which, securities traded and listed on the Official Market of the SEM meet the HMRC interpretation of “listed” as set out in section 1005 (3) (a) and (3) (b) Income Tax Act 2007. SEM is also regarded as a ‘recognised Stock Exchange’ for Inheritance Tax purposes.

In 2010, the SEM embarked on a re-engineering of its strategic orientation to move away from its historical domestic equity-centric focus to embrace a multi-asset class international focus.

In line with this strategic shift, the SEM revised its listing framework nearly every year between 2010-2020 to offer modern-based streamlined but flexible listing rules catering for a variety of products issued and listed by domestic Issuers, International Issuers, Investment entities and Specialist companies, namely: equity products (ordinary and preference shares), debt products (fixed income products, floating rate debt products, specialist debt products and Eurobonds), Exchange Traded Funds, Exchange Traded Notes, Depositary Receipts and Structured Products. It's with the same philosophy that SEM later set-up of a dedicated Africa Board for Africa-centric issuers and products.

SEM became in 2011 the only Exchange in Africa and one of the rare Exchanges in the world to possess a multi-currency platform, open for dual-currency trading that can list, trade and settle equity and debt products in USD, EUR, GBP, ZAR besides MUR.

2011 saw the listing of the first international company listed, traded and settled in foreign currency, namely USD. Post-2011 in fact witnessed tangible results in terms of new products with an international flavour as well as enhanced trading and capital-raising activities.

In September 2016, the SEM added two new indices to its suite of indices, namely the SEM-All Share Index (SEM-ASI) and the SEM-VWAP Index. SEM-ASI is an index which tracks the price performance of all companies listed on the Official Market, including the foreign-currency denominated companies.

The creation of SEM-ASI was inspired by the listing on the SEM of a growing number of GBCs, Specialist Debt Instruments, ETFs, Structured Products and DRs. Similarly, the SEM also successfully attracted the listing of a growing number of debt instruments over the years and hence it became opportune in 2017 to create a Bond index (SEM-BI). In 2016, the SEM infact became the first African Exchange to list a Masala Bond.

SEM has developed in 2017 a fast-track-listing route whereby issuers having a primary listing on select Exchanges, can submit the same listing application documents approved by the Exchange of primary listing to the SEM. The fast-track listing process effectively eliminates time, cost and management constraints for the issuer with regard to the preparation of application documents. Further flexibility introduced in the Listing Rules for international issuers having a secondary listing on the SEM also include a reduced regulatory gap as the post-listing obligations of the Exchange where the international issuer has its primary listing take precedence over the post-listing obligations of the SEM. On top of optimal turnaround time in guiding issuers them throughout the admission process, compared to peer-Exchanges, SEM also ensures a highly cost-effective and competitive listing fee structure, providing affordable entry and continued listing.

Investors today look for fully-integrated services with capabilities of doing everything from smart devices and want everything intuitive, instant and on-demand. Digital technology plays squarely into that space – provide fully-integrated instant, fast and on-demand investor services. In line with its transformational progress, SEM rolled out a fully-responsive website in 2019, running on emerging technologies, to improve access to Exchange information. In terms of content and design, SEM's website homepage features an entirely new dynamic look and feel, displaying a full suite of dynamic market information. Inside pages have been streamlined, grouping information on SEM's multi-asset classes efficiently and in an interactive fashion. This website embraces the wave of emerging technologies like AI, interactive charting & Tab/Graphic Displays, that improve investor experience. SEM website’s Data Centre also provides secure cloud services for market participants.

In 2020, the SEM added a new strategic dimension to its innovative thrust by amending its Trading Rules to create a conducive environment for the establishment of links with International Central Securities Depositories (ICSD's) like Euroclear and Clearstream.

This new enabling environment specifically applies to Debt Securities, Specialist Debt Securities, Eurobonds, ETF's, ETN's) and Structured Products listed on SEM and issued by foreign issuers to foreign investors or investment entities holding a Global Business Licence. In practice, this initiative allows foreign investors who own the above-named securities listed on the SEM and which have an ‘XS’ ISIN issued by an ICSD, to transfer these securities directly via the ICSD to other investors.

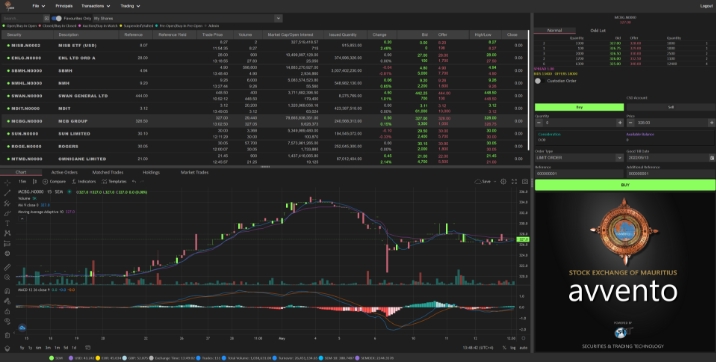

In May 2022, SEM marked the successful go-live of its new multi-asset Automated Trading System (ATS), comprising a rich and robust desktop trading front-end for brokers and a modern web and mobile mySEM App for investors at large. This overhaul of SEM's technological infrastructure enables SEM to continue on the path of innovation in pursuing its differentiation strategy to position itself as an attractive multi-currency capital-raising and listing platform, and move up the value-chain of products and services for its local and international stakeholders. The new solution also allows further growth and development of the market through the latest API’s and integration points for data distributors, remote brokers and custodian banks, as well as the ability to trade new potential asset-classes such as derivatives. The new ATS also incorporates a state-of-the-art Market Surveillance System which enhances RT surveillance of market activities. The alert engine runs in real time to raise any alerts for market abuse or irregular trading practices.

SEM launched in May 2022, a new fully responsive mySEM app with a new look and feel, retaining the key features of the previous one, while introducing new and enhanced interactive app functionalities The new mySEM app version is a Progressive Web App (PWA), delivered through the web via URL https://mysem.stockexchangeofmauritius.com and can be used on any platform (desktop and mobile), within the palm reach of investors. The mySEM app aims at empowering investors to follow the market in real time, seize market opportunities and trade in real time, and have online access to their CDS accounts to monitor their account activity and account status. In addition to the new look and feel, mySEM also provides investors seamless access to a wide variety of market data in real time, including company specific order books, highs and lows, best bids and asks, and other relevant company-specific data. It also introduces interactive charting for all listed securities on different time-scales up to 1 year. This new mySEM app relates to a number of ground-breaking initiatives implemented by the SEM in recent years to avail investors of improved digital services and enhanced trading and operational efficiency.

In line with SEM's Market Data Policy reform, effective 01-November-2023, any form of distribution for RT Level 1/2 and/or Delayed or EOD by Data Distributors and Re-distributors (to receive SEM data and re-distribute it to Data Users), requires SEM's approval and licensing with SEM as Contracted Distributing Users. Whether as a SEM Data User, you receive SEM data direct from SEM or Contracted Distributing Users for Display-Use and/or NDU, you are governed by SEM's Market Data Policy. If in relation to a licensee, as a client to whom the licensee distributes SEM data which you wish to use for external Display distribution, or as an affiliate or subsidiary or client you wish to use SEM's data for NDU, you must be licensed with SEM in the capacity of a Re-Distributor, and hence be subject as a licensee, to applicable Display and/or Non-Display fees. SEM became connected to Bloomberg and Refinitiv back in 2006 and in the next decade to Factset and ICE. Between 2019 and 2025, SEM made aggressive strides by adding on its list of world-class Data Distributors SIX, S&P Dow, FTSE, and S&P Global. Local investors account for about 65% of the daily trading on the SEM, and foreign investors account for remaining 35%.

Back in September 2015, the SEM launched its sustainability index (SEMSI) comprising 18 listed companies as of 2024, to provide a robust measure of issuers against a set of internationally aligned and locally relevant ESG criteria. SEM also became a signatory and Partner Exchange of the United Nation’s Sustainable Stock Exchanges initiative, in 2015.

A new chapter of the SEM’s history came with the listing of the first Green Bond on the Official Market, in October 2023. This first listing is expected to foster further listings of green/sustainable bonds, trigger the listing of the first sovereign sustainable bond on the SEM, and eventually raise the profile of Mauritius and SEM as a funding, issuance and listing platform for sustainable finance in Africa.

15th March 2024 marked the launch of the Partnership between SEM and Risk Insights on the rating of ESG reporting by SEM-listed companies and other unlisted companies in Mauritius. SEM aspires to make a strong case for Mauritius to take a leadership role in the issuance of Sustainable Financial Products on the domestic front first to gain international visibility and, then, to leverage on the Global Business sector to position Mauritius as an issuance and listing platform for Africa-linked Green and sustainable products. Risk Insights has the expertise in running the AI methodology to rate companies and the different ESG criteria that underpin RI rating tools.

SEM added a new strategic dimension to its innovative thrust by launching on 03 December 2024, SEMX. SEMX focuses on the listing of fast growing, profitable companies, which at the time of listing already demonstrate strong growth in revenue of at least 25% on a CAGR basis over the prior three financial years or 100% reasonably spread over the last five years.

The last decade has witnessed salient breakthroughs and defining changes to strengthen its competitive position as a multi-asset class internationalized Exchange and create the enabling environment for the listing and trading of international products. Looking forward, the split of listings on SEM is expected to have a growing share of equity products, debt products (fixed income, floating rate debt, specialist debt and Sovereign Bonds), ETFs, ETNs, Structured Products and Sustainability Products of an international flavour.